27+ Maryland Sales Tax Calculator

Local tax rates in Maryland range from 000 making the sales tax range in Maryland 600. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

26310 Johnson Dr Damascus Md 20872 Mls Mdmc709478 Redfin

For example if you paid a four 4 percent sales tax.

. Because Maryland does not have discretionary taxes it is easy to compute the sales tax. 40000 Sales Tax Rate. The above rates apply to Maryland taxable incomeMaryland taxable income is based on your federal adjusted gross income AGI but with some differences.

The sales tax rate does not vary based on location. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Maryland local counties cities and special taxation. The sales tax rate in Columbia Maryland is 6.

For a breakdown of rates in greater detail please refer to our. Find your Maryland combined state and local. Before-tax price sale tax rate and final or after-tax price.

The goods news is that Maryland sets its Sales Tax Rate as a flat rate across the State so although the Sales Tax Formula Still applies. Use free Sales Tax Reverse sales Tax Calculator for Maryland state and its cities. It is not just 6 but defined as follows.

Every state that has a sales tax also has a use tax on the purchase of goods and services as defined by lawState sales taxes apply to purchases made in Maryland while. Calculate Car Sales Tax in Maryland Example Initial Car Price. 1 cent where the.

This encompasses the rates on the state county city and special levels. Maryland Income Tax Calculator 2021. Sales and Use Tax.

Gross Price Amount after Tax. Sales tax rate in Maryland is defined quite precisely. Your average tax rate is 1198 and your marginal.

Sales Tax Rate s c l sr. Also get the complete list of latest sales tax rates. 2000 Sales Tax 40000 06 Sales.

Sales Tax calculator Maryland. The state of Maryland contains. Multiply 06 by the sales price of each item.

The sales tax rate does not vary based on county. Maryland grants a credit for sales tax paid to another state up to the amount of Marylands six 6 percent sales and use tax liability. If you make 70000 a year living in the region of Maryland USA you will be taxed 11612.

The most populous location in Maryland is Baltimore. The base state sales tax rate in Maryland is 6. For example if Widget A costs 150 determine.

Sec Filing Roivant Sciences Ltd

Autologous Bone Marrow Transplantation Blog Science Connections

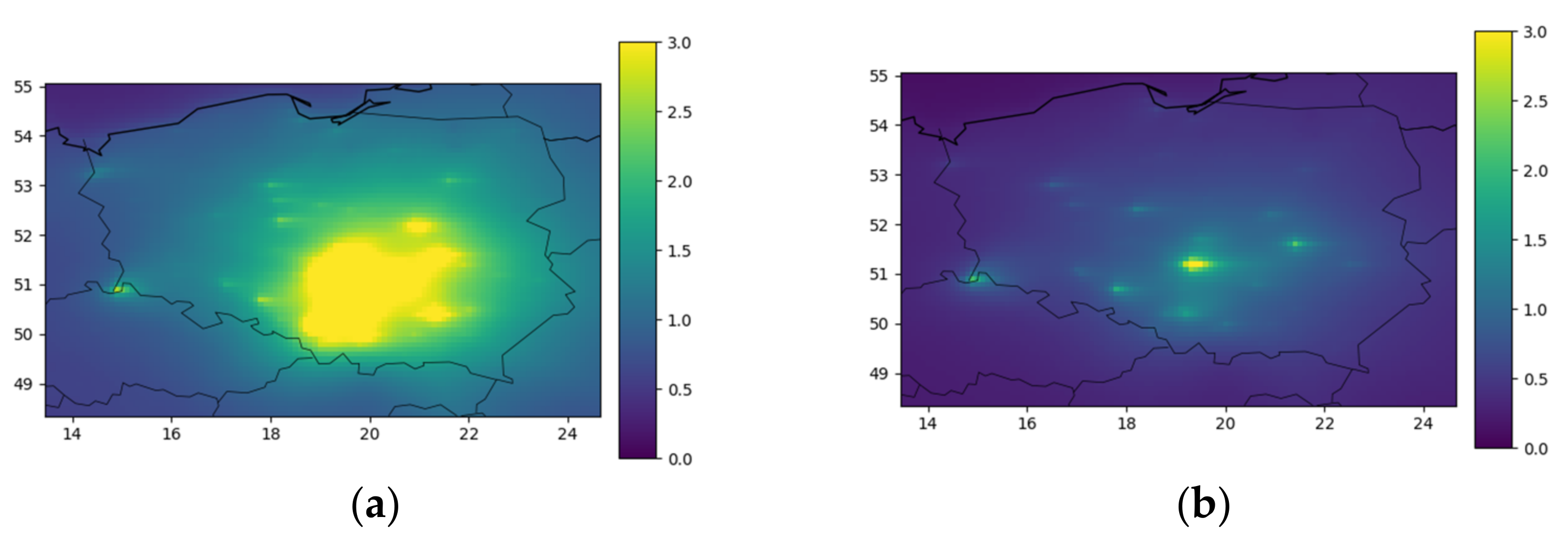

Energies Free Full Text The Health Impact And External Cost Of Electricity Production

10 75 Sales Tax Calculator Template

Obesity In Children And Young People A Crisis In Public Health Lobstein 2004 Obesity Reviews Wiley Online Library

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMIB3XYNINFGDC57SZO7YHMUWQ.jpg)

Here Are The Highest Paying Jobs In Charleston That Don T Require A College Degree

Spacious Custom Designed 1st Fl 4br Condo Five Doors To Beach Boards

1090 Pearidge Rd Bostic Nc 28018 Mls 3919251 Coldwell Banker

The Ideal Retirement Age To Minimize Regret And Maximize Happiness

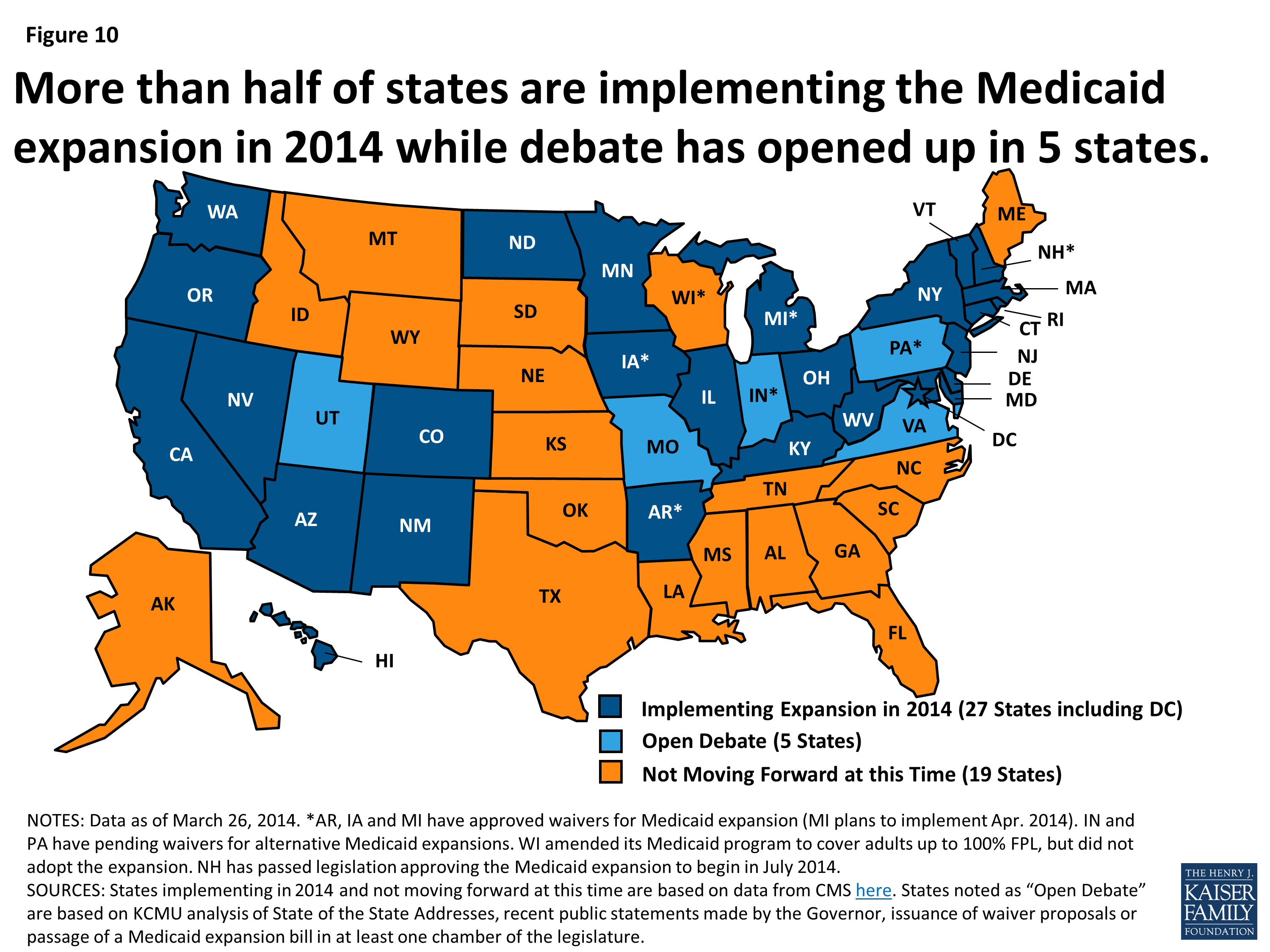

State Fiscal Conditions And Medicaid 2014 Update Issue Brief 8572 Kff

Microbiome Connect Usa 2023

December 2020 Baltimore Beacon By The Beacon Newspapers Issuu

A Wave From It All Ship Bottom Nj

The Knots Book 27 Most Practical Rope Knots Brand New Free Shipping In Th Ebay

505 Wye Hall Drive Queenstown Md 21658 Compass

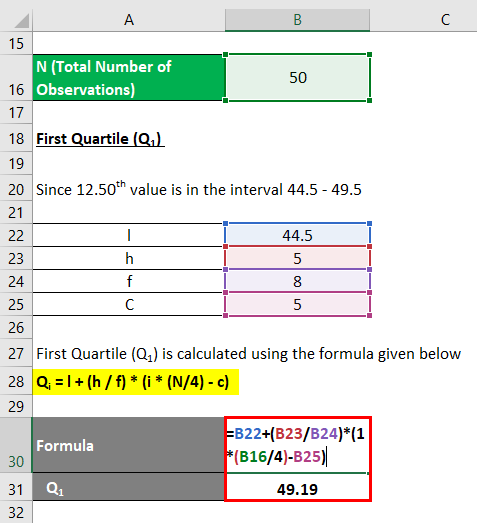

Quartile Deviation Formula Calculator Examples With Excel Template

Maryland Income Tax Calculator Smartasset